Nope. No less than I’ve not ever been advised on the an incident in which it taken place. That money is a good-faith deposit. Provably will cost you money, I would create. The loan processor can not work free-of-charge. The latest underwriter does not work for free. New escrow officer doesn’t work at no cost. The appraiser cannot, new label team does not. No-one works best for 100 % free. Phone calls and duplicates and keyword processors to create each one of your articles from the name commitment to the loan records. Particular data files are exactly the same each mortgage and certainly will end up being computers made. Anyone else, such as the term connection, wanted people to get in virtually what you on it.

Lawfully, it was an incentive for this lender to-do the new work of the financing, which will set you back currency

However, in initial deposit for more than appraisal and credit file isn’t really expected. In reality, you will find creditors nowadays (I became included in this, and wish to end up being again, but when i is also blow of a beneficial $20 credit score assessment in case your financing does not money, I really don’t build sufficient money away from funds that financing make it possible for me to pay money for $400 plus appraisals for funds which do not) exactly who consistently functions the entire mortgage to the speculation of it financing. They could https://paydayloancolorado.net/jackson-lake/ ask you to pay money for the financing report and appraisal at the start, but everything else is purchased when the work is complete additionally the financing fund. I would personally much favor you generate brand new evaluate for the appraiser when they perform some works, but I can not lawfully do this anymore. You can inquire the huge benefits towards the consumer from the. One to advantage would be that these types of financial institutions aren’t carrying your finances hostage.

Consequently if for example the mortgage drops apart due to the fact mortgage supplier told you they might do the financing as well as couldn’t, they are from the money, perhaps not your

During that revision, legislation of going funds has evolved much in the last few years, and it is on benefit of the newest financial or other notice organizations, perhaps not the user. Check out the individuals responsible for Congress with the reason (Dodd-Frank, to-be particular). In addition, the lenders are instituting more changes as they can, now that there are several fewer loan providers much less battle. I am not happier regarding the some of it, but probably the most useful loan officials have one or two alternatives: Adapt as the top we could, or get a hold of a different collection of work. When your best mortgage officers trying their hardest to assist users hop out, ask yourself what can remain?

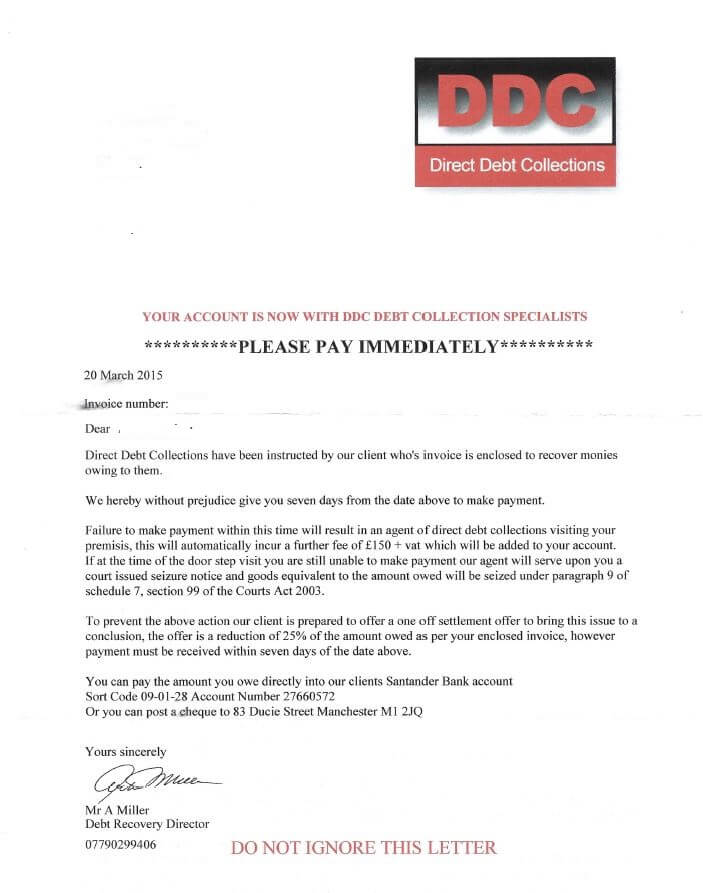

Anytime a loan provider wants a large cash put up front to start the loan, it’s likely that you shouldn’t have in it. Then they want to secure you in their mortgage by carrying your money hostage, and in case you will find on closing which they added tens and thousands of dollars onto the financing charge that they easily “forgot” to tell your throughout the otherwise pretended failed to exists (“Escrow’s an authorized costs. We don’t must let them know regarding it up until after”), now youre facing an option ranging from forfeiting their put and you can finalizing away from to the a loan that isn’t everything you consented in order to once you provided all of them one to deposit. Don’t to stand you to selection, of the not agreeing to invest something outside the credit commission up front side, and assessment whenever purchased. The reason for this article is in order to see – before you sign financing software and you will hand over in initial deposit – exacltly what the choices are additionally the possible outcomes to you personally.

Why they need large amounts of money of your upfront try several-flex. First, they produces that emotional connection We discussed a bit straight back. 2nd, it does make you financially dedicated to financing, and that enormously raises the number of mental relationship. It means they have a number of funds. Most people don’t very discover finance, maybe not deep-down in which it matters. Thought, for a moment, which you like to features: $400 dollars, or financing that will cost you $5000 smaller (not very in addition while making a positive change regarding $twenty-five on the payment per month), it is or even the same. Dispassionately sitting there for the monitor at hand, the possibility appears visible. You’ll have to pay one to $5000 right back a while, along with brand new interim you may be paying rates of interest in it. But flow they in order to a situation where this type of potential clients has currently put down a good $eight hundred put with a costly lender, as well as the most of these would not register for my personal financing. As to why? Because they’re thinking of one to $400 from inside the dollars you to definitely appeared of the family savings, perhaps not the fresh $5000 inside the even more equilibrium on their mortgagepanies require you to definitely deposit so you’re able to prevent you from going someplace else, to help you a loan provider that will do the loan (or, moreover, are happy to carry out the financing) getting a lot less money. Virtually speaking, they’re not just encouraging themselves a lot of currency, he could be assure that the client would not alter the brain on the financing.

Recent Comments