Ready to improve proceed to an alternative home? Connection financial support might be an elegant substitute for the newest logistical and financial demands away from transitioning from your old to your brand new home.

So many alternatives

Purchasing your beginning can be pleasing and you may frightening, but the strategies, no less than, are simple. Store, make a deal, offer notice towards the property owner, intimate and you will disperse. Sadly, the logistics out of a move when you currently individual property are not as basic. And several of one’s prospective routes send would be reduced-than-tempting.

Record your current house for sale and you may providing a jump out-of trust the prime new home tend to hit the market is that solution… but what when your best domestic does not appear in time? You can find yourself scrambling to have meantime casing.

Otherwise wanted the pressure of trying so you can dovetail this new time of deals and purchase, you can intend on moving twice. Put your blogs when you look at the shop and rent lodging whenever you are ranging from properties. However, swinging actually fun – and moving double (though it’s organized) is actually double the trouble and expense.

An alternative choice is always to wait for the checklist your home up to you find the place you are interested. If the primary new home comes along, become a backup getting selling your current domestic on your bring. Tunes effortless enough. But, however, the supplier need to be happy to accept a contingency. The majority are not – specifically if you was fighting up against most other has the benefit of.

Get first, then offer

cash loans Upper Bear Creek no credit check

A glaring response is to help you decouple brand new timing of the purchase and you will profit by purchasing your brand new household prior to attempting to sell their old domestic. This new strategies of your move score good hell of many easier. Shop for the right place, develop a robust (non-contingent) offer, personal, get keys and make the new circulate at the amusement. Up coming prepare, phase, listing market your own old house. Effortless peasy.

Or perhaps perhaps not… every collateral on your own dated house is nevertheless tied and you will unavailable to put down on your brand-new domestic if you do not promote. If you can’t discover a different way to obtain resource for the deposit, you are back again to rectangular you to.

What’s a bridge mortgage?

Playing with a bridge mortgage, you will be able to power the fresh equity in your newest the place to find buy your new house. When you yourself have enough collateral in your dated family, you may even have the option to purchase your new house having zero bucks downpayment.

How does they works?

This can be entitled cross-collateralization. The lender uses one another their dated and you may brand new home as the collateral for your financial, which means you rating borrowing from the bank on security on the old possessions into the acquisition of the fresh possessions.

An illustration

Imagine if your existing domestic value try $five hundred,000 and also you owe $100,000 on your own financial and you may $fifty,000 into the a home equity line of credit. You want to buy a beneficial $700,000 domestic. You’ve been residing in their dated family and propose to move into brand new home The newest mathematics happens like this:

With $750,000 offered equity, you might money a beneficial $700,000 with no bucks down payment called for. The brand new $fifty,000 off extra readily available collateral can be used to funds your own settlement costs.

Spreadsheet work with your own quantity!

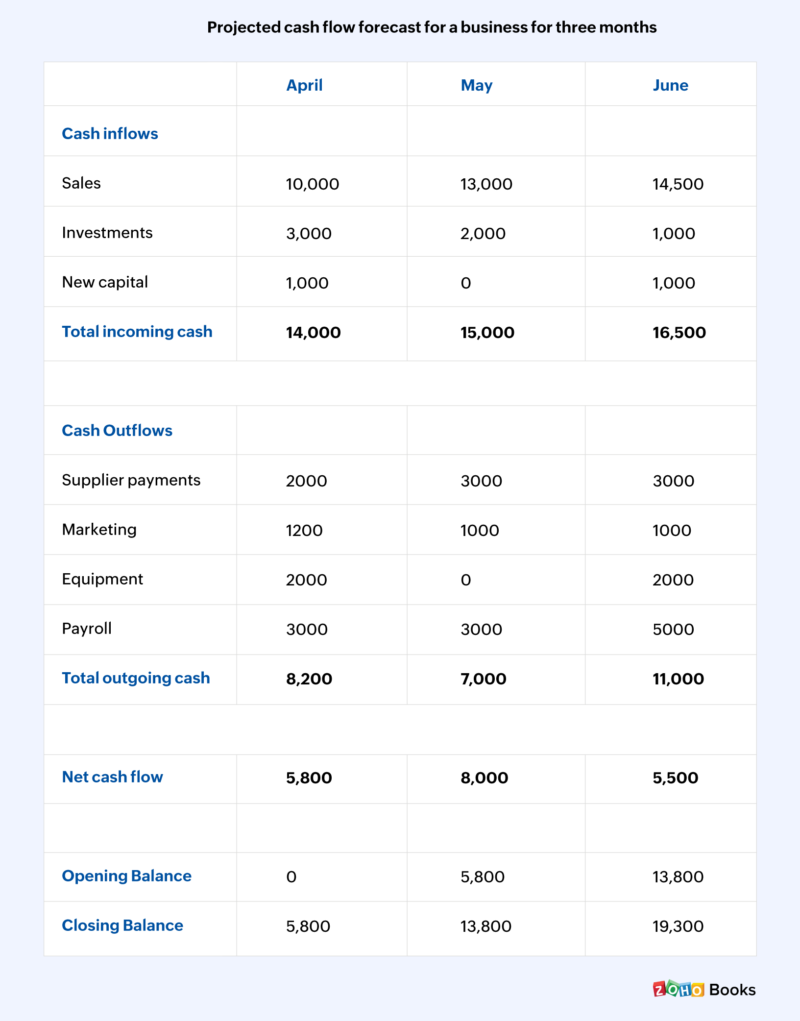

Must test out their quantity? Use this helpful spreadsheet observe exactly how bridge money you’ll pencil out to you personally.

Arrange for the latest interim

While using the a bridge loan, don’t forget to plan for the newest inevitable interim window of your energy when it is possible to very own a couple house. You will need to carry the cost of both land regarding day you close towards the acquisition of the new home up until your day you intimate on the business of one’s dated household.

Recent Comments