Still Dreaming from a dream Family?

Will you be waiting patiently into celebrities so you’re able to fall into line to make your dream of homeownership a reality? Chances are, you don’t have to a cure for long. Discover earliest-day homebuyer gives readily available that will help you eventually grab the second step toward their having your basic family.

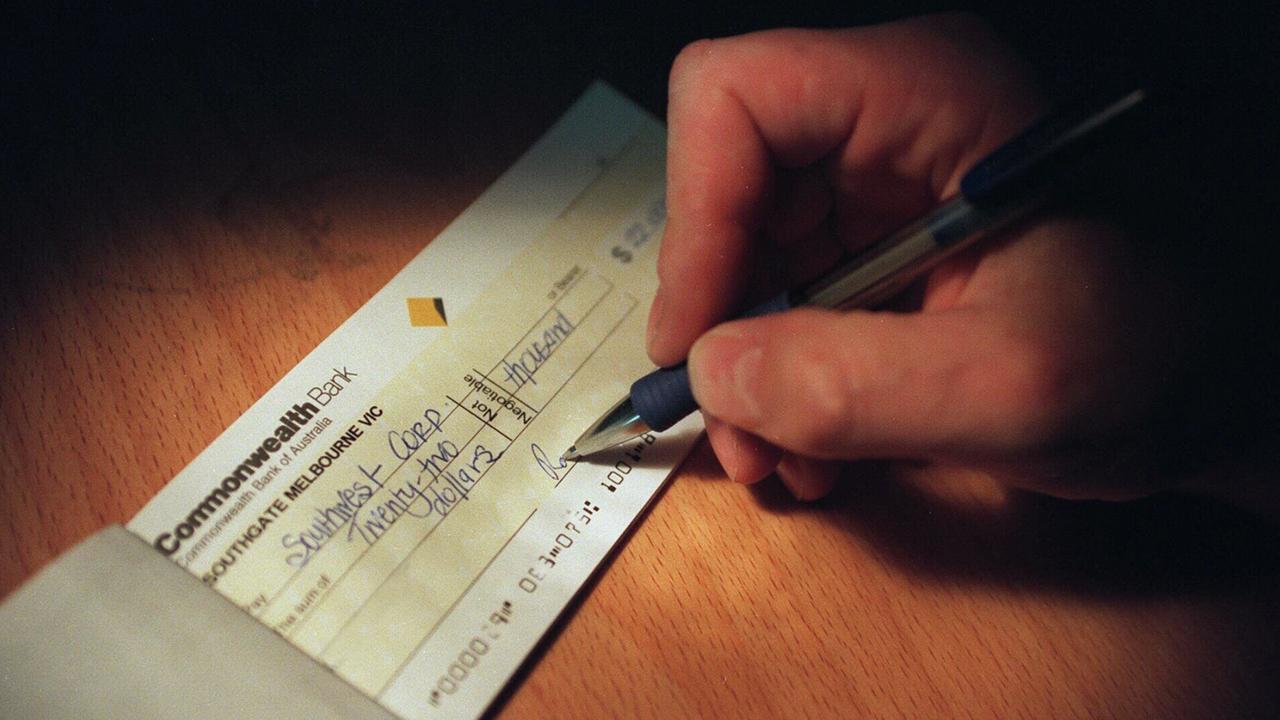

Possessing property was significantly distinctive from leasing otherwise coping with anyone else. Hence candidate by yourself should be each other daunting and you can appealing. Financial obligations also can play a role in pressure relevant having to get a house. People recommend the only method to move forward is with an effective 20% or more advance payment resting on the banking up with you to definitely amount of deals shall be very daunting for many individuals and you will family members. Upcoming incorporating in conclusion can cost you and additional charges, it will check very nearly impossible to become a citizen.

Even with how tough it does look, you will find first-date homebuyer offers and you can programs, certain to help you Pennsylvania residents, which will help. Finding an affordable home loan price, sensible down-payment numbers, and never-so-frightening closing costs is largely some feasible.

The brand new PA Housing Financing Agencies, otherwise PHFA, has several offered financial applications and get guidance apps well worth examining. Eligibility standards, in addition to money, borrowing from the bank, and place, are very different per system. To help you learn for every single available advice system, you will find build a broad assessment and inclusion.

Earliest Door (FFD)

First Entry way might help the individuals looking to purchase their very first home by the offsetting closing costs and down payments. For each and every dollars you might lead, performing FFD organizations will give around three bucks when you look at the guidance matching, up to $5,000. To learn more about learning to make FFD do the job or to observe you can be considered, get in touch with otherwise visit a keen FFD supplier and ask specifically towards First Door grant.

PHFA’s The brand new K-Complement System

The fresh Pennsylvania Homes Funds Company is starting a special system titled the Keystone Forgivable for the 10 years Loan Program (K-Fit.) This type of guidance system was designed to promote an extra financing having a forgivable price off 10% over 10 years. The application form allows you to pay-off the bill after you sell the home, never ever build a cost, secure direction to 5% of the purchase price, in fact it is according to a zero % focus model. If you reside in the home, the loan is forgiven versus actually while making a cost. You will find several standards, also the very least 660 credit score, earnings restrictions, that loans are considered toward a man-by-person foundation. Approval will also be computed inside particular loans-to-money parameters and additionally a 401K and you may a checking account.

PHFA Keystone Government Virtue (K-Gov)

The K-Gov program offers in order to 4% or $6,000 from inside the guidelines, any sort of is lower. and is not forgivable. The help is offered in the form of a 2nd mortgage. Even though this loan is not forgivable, its paid off over ten years notice-totally free. People do not spend one focus to the recommendations portion. Anybody can implement who is looking to buy the very first domestic.

Keystone Mortgage that have Advantage

An alternative 2nd mortgage which can be incredibly helpful in realizing your own homeownership aspirations is the Keystone Advantage Recommendations Mortgage Program. Such loans is up to cuatro% of the house’s rate, or $6,000. Part of the difference with this system ‘s the money maximum. This program has actually a full time income restriction, where K-Gov cannot. So it program lets buyers to take out a moment financial quickly to aid shelter deposit criteria otherwise settlement costs.

For other basic-go out homeowners whom meet specific conditions, it, as well, can potentially qualify for the fresh new HOMEstead Down payment and Closing Pricing Guidelines Mortgage. This option, just like the Keystone Advantage Guidance Mortgage System, will bring a chance for an additional home loan. Which financing is out there with no interest.

Availability Domestic Amendment Program

For any very first-time homeowners which have an impairment within the household can also be be eligible for this type of programs. In addition to possibly becoming qualified to receive additional readily available grants, the new Accessibility Household Amendment Program brings mortgages which can be utilized for the means to access modifications. Help online payday loans Nebraska list make your fantasy home perfect which have correct doorway widths, training gizmos, and you may roomy hallways using this program.

Do not let the fresh finances intimidate you otherwise get in your way of becoming a resident. If the crunching the newest number have kept your waiting forever, check into some of the first-date homebuyer grants. You could be family-search a few weeks. And several of one’s barriers clogging your way to purchasing a good household could well be brought up. For much more help with tips and starting your first-go out home buying journey, let the masters at Homeway Real estate assist change your dream on a dream domestic facts.

Recent Comments