This article in order to credit covers a few of the key factors you must look into when deciding on an educated financing for your needs.

Among the many anything you’ll want to think when selecting the newest most useful mortgage is whether we would like to safer your own borrowing from the bank. Right here, we will talk about the difference between from the americash loans Sand Rock safeguarded and personal loans.

Secure borrowing, including mortgages, fundamentally relates to straight down monthly repayments more a lengthier label than simply unsecured borrowing. But overall, you’ll be able to pay off over you’ll over a shorter months. Also, it does bring a higher risk while the mortgage can often be protected against your property.

Secured personal loans try most suited getting larger, one-off sales or expenses particularly home improvements, debt consolidating or a separate auto.

- You could potentially constantly commit to less Annual percentage rate (APR) than just toward an unsecured loan. Toward downside, for individuals who default (are not able to keep up money) on your own mortgage, your exposure dropping your home

- You can usually invest in generate lower monthly costs. Into downside, you’ll have to expand the borrowing from the bank identity to accomplish this which means that possible pay back an elevated matter complete

- Should your collateral in your house is worthy of substantially more than just the new a fantastic mortgage, you will be able to offer your loan although not fundamentally in one rate of interest as your established mortgage

- But once again, whenever you are using a guaranteed mortgage to settle multiple unsecured money, your home is at stake if you don’t maintain payments

Think in advance of protecting other expenses against your property. Your house can be repossessed unless you maintain repayments on your own home loan.

Unsecured loans

Or even own your own home or you should not secure your house facing a loan you could sign up for an enthusiastic unsecured personal bank loan, overdraft otherwise make an application for a charge card. Here, we look at for every single in detail.

They are often repayable for the fixed monthly instalments from the Head Debit more than a predetermined several months. Most people obtain between ?1,000 and you can ?fifteen,000 however you you will obtain faster or more with regards to the bank, whether you really can afford the borrowed funds and if you have got a good legitimate you prefer.

They’ve been linked to your membership. They truly are useful different orders and costs including paying bills otherwise to purchase the furniture for your house.

Overdrafts is actually versatile and simple to apply for. An enthusiastic authorised overdraft might be great value for the short term or in a crisis, but straying outside of the conformed limit would mean costs and you may probably higher attract charges.

Handmade cards is actually a separate versatile technique for borrowing. They are used for multiple purchases, such as purchasing goods, footwear looking otherwise spending expense.

Besides the absolute minimum month-to-month balance commission, credit toward playing cards enables you to repay your debt in your own day. However, for folks who just improve minimal commission monthly, it will take you longer and cost your a lot more to pay off what you owe. You are able to make lump sum payment money. Be aware of the rates, as the higher prices can also be spell poor worth for longer-identity credit.

What are you borrowing to possess?

It is vital to feel obvious on exactly why you require currency before you choose a knowledgeable mortgage to you. Such as for instance, credit cards can be handy to possess short-title or crisis credit but these include a pricey treatment for fund larger or expanded-label financial requires.

Exactly what do you afford?

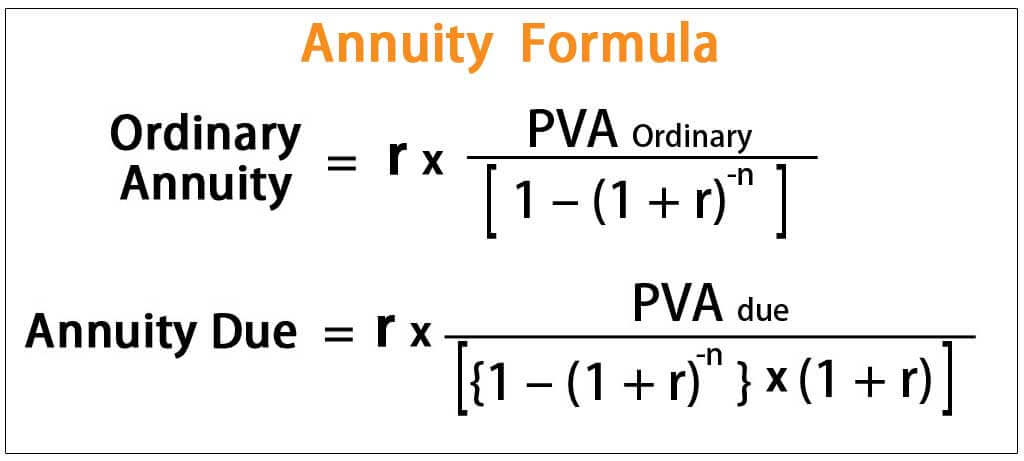

In the ideal peak, ount of interest you only pay also costs such as plan charges and you will yearly costs if in case as well as how commonly which have to be reduced. Nevertheless the Apr is helpful tips. It might not were even more costs it’s also possible to happen, instance early installment charges for loans and you will late percentage charge having notes. Concurrently, you do not be eligible for the speed looked on post you notice. Be sure to look at the small print. To genuinely examine funds, focus on the genuine count might repay and over exactly how enough time.

It is advisable that you pay the mortgage as quickly as possible but watch out for early repayment charge. Lenders tend to costs lower rates of interest for individuals who use huge number otherwise pay-off more a longer time. not, this new stretched the phrase, more attention you’re going to have to pay off altogether.

When you get turned-down

For those who apply for a loan, you have a cards resource department browse over you you to definitely actually leaves an excellent ‘footprint’ on the credit rating this can affect upcoming borrowing from the bank requests. For individuals who remain obtaining financing and also have rejected, it has a negative affect your ability to track down credit subsequently.

For individuals who change your head

Have fun with one cooling-from period included in their borrowing from the bank otherwise financing arrangement to really be sure to find the money for pay the loan and you may fulfill the requirements of the newest small print.

Loans be careful

Don’t let desperation be your motivation to own credit significantly more it will only end in larger troubles. Moving multiple pricey expenses into the that minimal financing to minimize their outgoings will likely be smart however, borrowing from the bank more on most useful associated with is not.

Recent Comments